2021 ev tax credit rules

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. This new legislation titled Clean Energy for America could potentially raise the EV tax credit from a max of 7500 to a maximum of 12500.

How Does The Federal Tax Credit For Electric Cars Work

TSLA battery supplier Panasonic Holdings Corp OTC.

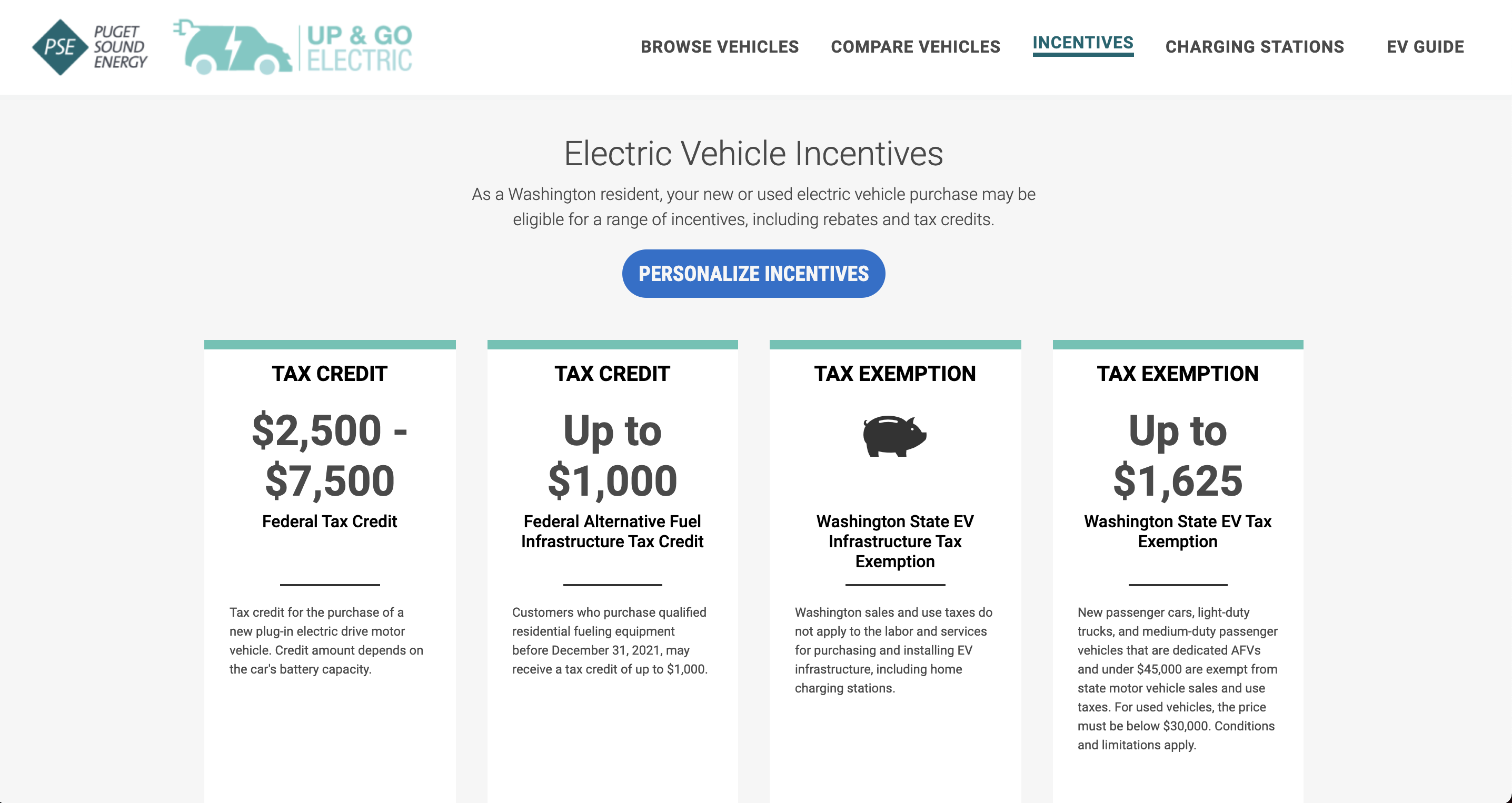

. The federal rules also provide for a 30 tax credit 26 for 2022 up to a maximum of 1000 against the cost of purchasing and installing a home EV charging station. For vehicles acquired after December. US congressional leaders have agreed to a bill that would expand the existing 7500 new EV tax credit while introducing the first federal tax credit for used EVs.

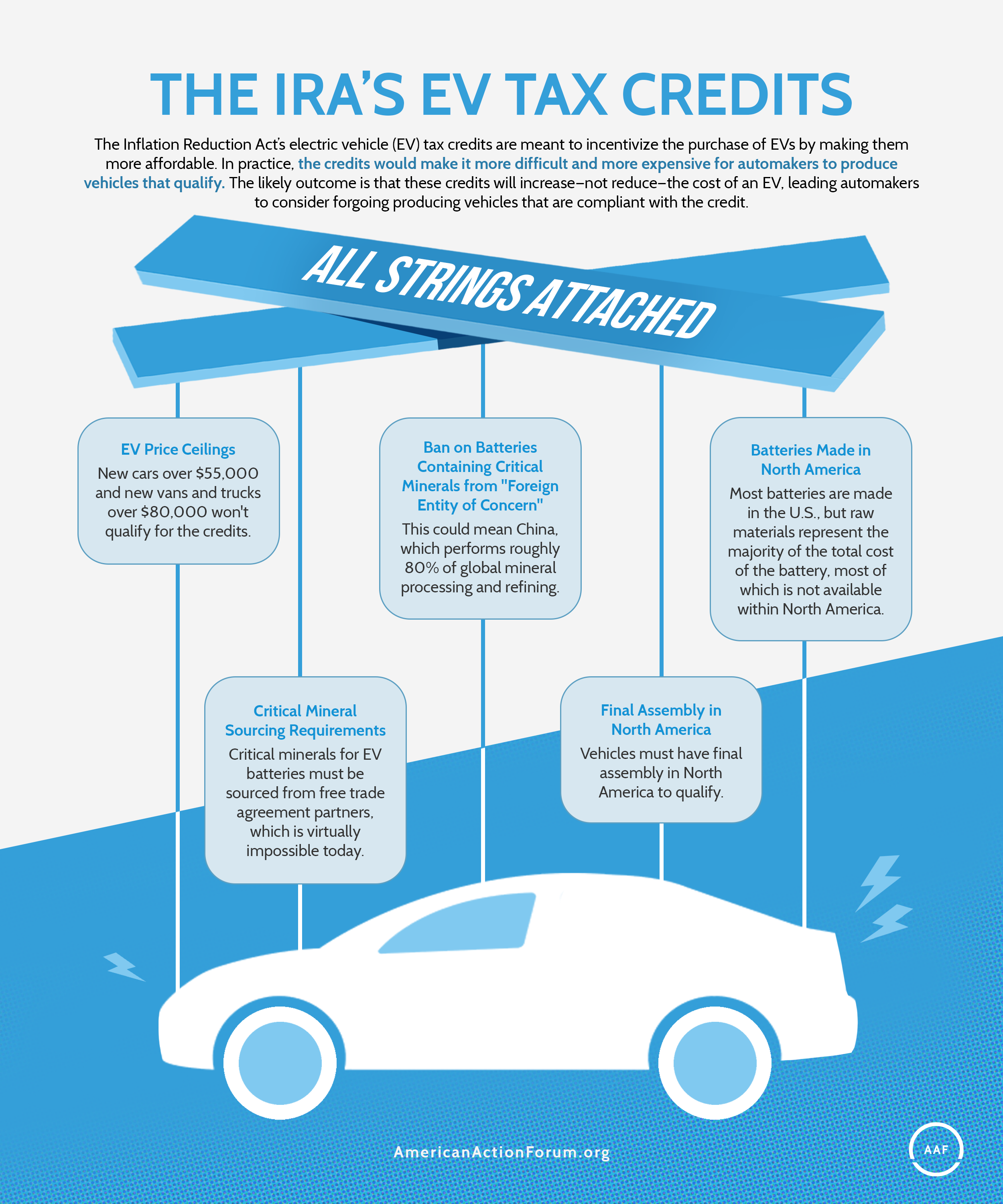

However theres a little bit of catch. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and.

The credit amount will vary based on the capacity of. The time period for most businesses to claim the ERTC on qualifying wages. Micah Toll - Nov.

Child Tax Credit Changes. Tesla Model X Tax Write Off 2021-2022. Since the US added EV tax.

The bill includes a transition rule that. The new tax credits replace the old incentive. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

Qualifying businesses can claim this credit on qualifying wages paid from. 25 if you acquired it after June 30 2019 but before January 1 2020. The exceptions are Tesla and General Motors whose tax.

If a single person purchases two eligible plug-in electric vehicles with tax. When President Biden signed the Inflation Reduction Act on August 17 a new rule took effect requiring that final assembly of EVs must occur in North America to qualify for a EV. If you purchased an eligible EV or PHEV prior to August 16 2022 the tax credit should still be valid on your 2023 income taxes even if that vehicle is no longer on the approved.

421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The new IRA of 2022 bill also allows for. This requirement went into effect on August 17 2022.

Tesla Inc NASDAQ. EV Tax Credit Expansion. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

August 16 2022 - Most new electric vehicles on sale lost eligibility Tuesday to qualify for up to 7500 in federal EV tax credits after Dec. 31 under revisions made in the. What does that mean.

PCRFY aimed to start building a new battery plant in Kansas in November with mass. If you were in contract prior to the law you can use the old law to get the EV credit if you are buying a vehicle with outside the US assembly. The Inflation Reduction Act eliminated the old EV tax credits immediately but the new credits dont go into effect until January 1 2023.

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year.

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

Ev Tax Credit Gets Surgery But There Are Complications Automotive News

Bmw Electric Plug In Hybrid Vehicle Tax Credit Update For 2023

Top 15 Faqs On The Income Tax Credit For Plug In Vehicles

Vinfast Says Preorders Will Get A 7 500 Rebate Federal Tax Credit Or Not Techcrunch

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

What Car Buyers Should Know About The Coming Tax Credits For Evs Los Angeles Times

Ev Tax Credits On The Table As Democrats Try Reviving Parts Of Build Back Better The Hill

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Lots Of People And Automakers Have Cheated Ev Tax Credit Feds Say

The U S Government Plans To Slice 7 500 Off Electric Car Prices But It S Complicated The Autopian

Will Inflation Reduction Act Give Tax Credit For Electric Vehicles Deseret News

Why The New Ev Tax Credit Would Be A Game Changer For Electric Cars Grist

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra